Monopoly is an industry

that composed of a single seller of a product with no close substitutes and

with high barriers to entry.

For example, Microsoft Corporation

Characteristics of monopoly

v Single seller

Ø the firm which is also known as the monopolist and the

industry are one and the same.

v Price maker

Ø the firm is able to choose a profit maximizing price

from a range of prices imposed by market conditions and competition.

v No close substitute for the product

Ø this is because there is no close substitutes for its

product, the monopoly faces a little competition.

v Barriers to entry for new firms

Ø It is legal or natural constraints that protect a firm

from potential competitors.

Barriers to entry is the firms which already possess market power can

maintain the power either by restricting other firms from producing an exact

duplicate of their product or by restricting firms from entering the industry.

Example of barriers to entry

Ø Patents/Copyright-A patent is granted by the government, giving the exclusive right to the inventor to sell a new period of some period of time. A copyright is an exclusive right to the author or composer of literary or artistic work and it valid for a limited time period.

-It is enjoyed by the existing firm that produces large output. The size of large firm provides the advantage of having a lower average cost in production.

-If a firm governs the supply of important inputs to produce a particular product, this will serve as a barrier to entry until an alternative source of the inputs is found or an alternative technology not requiring the input is developed.

Well, Let me tell

you why Microsoft is a Natural Monopoly

Microsoft has a great reason to establish

and maintain a monopoly, if it could do so without true competition forcing it

to reduce prices. Software is unlike any other business. Because the marginal

cost of software is virtually zero (and in the case of OEM distribution and

volume licensing actually is zero, since the licensee pays for any packaging

and distribution), its average total cost continually declines with volume, and

because expanding the number of software units only involves making copies,

there are no diseconomies of scale and no necessity to increase fixed costs.

Because marginal cost is so low, average total cost continually declines as it

asymptotically approaches marginal cost, and unlike many other industries,

average total cost never rises. Thus, Microsoft is a natural monopoly.

Sales figures and cost of development for

software are hard to come by, especially with multiple versions and constant

upgrades becoming available, but consider this. According to Microsoft (Microsoft

Office Now Fastest-Selling Business Application Ever),

Microsoft sold more than 20 million licenses of Microsoft Office 97 in less

than a year, at the average of rate of 60,000 per day! Furthermore, Microsoft

already had an installed base of 55 million for its desktop applications prior

to the release of Office 97 (Microsoft

Office 97 Released to Manufacturing). With the number of

computer users still growing rapidly during the late 90's, it certainly is not

unreasonable to assume that Microsoft sold at least 50 million copies of Office

97 in the 2 ½ years between its initial release on November 19, 1996 and the

release of Office 2000 on June 10, 1999. (An average rate of 60,000 copies per

day for 933 days yields 55,980,000 copies, so 50,000,000 is a conservative

number.) Let's further assume that Microsoft received an average of $200 per

copy, not an unreasonable figure considering that MS Office prices ranged from

a little over $200 to over $400 for an upgrade, depending on version, and

almost double that for a full version. Let's further assume that it cost

Microsoft $50 million dollars to develop Office 97. Again, not unreasonable

when you consider that Office 97 was an upgrade to Office 95, so it wasn't like

they were creating the software from scratch. The cost could be considerably

less than this, because, (1) as I have already argued, Microsoft's goal is to

add as little value as possible to each upgrade; and (2) much of the code

between programs is shared, thus reducing costs even more. Multiplying price

per copy by the number of copies sold yields a staggering $10 billion in

revenues. (It has recently been reported that Microsoft receives 40% of its

revenue from Office; thus, that's almost $10 billion in ONE YEAR!) Subtract the

cost of development and the cost of packaging yields $9.7 BILLION in profit!

That's a staggering profit margin of 97%! The profit earned per unit sold is more than 33 times what the unit cost!

Of course, Microsoft as a company doesn't earn this much profit or have a

margin this high, because it is diluted by fixed costs, administrative and

marketing expenses, and the company's other, less profitable, endeavors and

other monopolizing efforts, but, nonetheless, its profit margin as a whole for

1999 was 39.4%, far higher than most other companies. In the last 5 years,

Microsoft's profit margin has increased from 24.5% in 1995 to 39.4% in 1999 and

this trend will only continue as Microsoft sells more software to a wider,

worldwide market, simply because the marginal cost of software is very little,

so the average total cost of each unit continually declines! (Compare

Microsoft's profit margin and growth to super-efficient Dell

Computer (page still available, but displayed

info reflects latest data), which has an average profit margin of less

the 8.5%!)

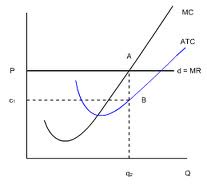

Monopoly in the short run:

Situation A:Microsoft Corporation is earning economic profit when P>ATC or TR=TC.

MC=MR when Q1 is produced. So Q1 is known as profit maximizing level of output. At this output level, price which is denoted as P1 is greater than ATC which is denoted as AT C1.

Total revenue=Economic profit + Total costs

Since TR>TC, Microsoft Corporation

is earning economic profit.

Situation B:

Microsoft Corporation is

earning normal profit when P=ATC or TR=TC

MC=MR when Q1 is

produced. So Q1 is known as profit maximizing level of output. At this output

level, price which is denoted as P1 is equals to ATC which is denoted as C1

Total revenue: Area

A

Total cost: Area

A

Since TR=TC,

Microsoft Corporation is earning normal profit and the economic profit is equals to zero.

Situation C:

Microsoft Corporation is

incurring economic loss when P<ATC or TR<TC

MC=MR when

Q1 is produced. So Q1 is known as profit

maximizing level of output. At this output level, price which is denoted as P1

is less than ATC which is denoted as C2

Total revenue

:Area B

Total cost: Area

B

Since TR<TC,Microsoft Corporation is facing economic loss and the loss area is A.

Monopoly in the long run:

In the long run,

the output that maximizes the profit is when the long run marginal costs curve

(LMC) curve intersects with the marginal revenue curve of that monopoly.

As the below

diagram shown how the long-run

equilibrium of a monopoly is achieved. Observe that in the

long-run, the Microsoft Corporation is still able to gain supernormal profit. This condition occurs for company that

obtain monopoly power through the granting of license by the government. Pressure

towards profit does not occur. This causes the supernormal profit enjoyed to

remain even in the long-run. From the diagram above, it is clearly shown

that the continuous long-run average costs curve faces decline. This means that

the Microsoft Corporation obtains cost advantage compared to its competitors. In the long-run as well, the Microsoft Corporation can

experience normal profit or decrease in profit. Competitors might create

substitute inputs for the input controlled by the monopolist. Competing

firms supplying outputs that have similar use as the output supplied by the

monopolist can also emerge in the long-run. This causes the profit gained by

the monopolist to decline.

1 comments:

Monopoly does not benefit the consumers as the price set by monopolies are very high and results in substitutes by smaller firms. How would Microsoft tackle this problem?

Post a Comment